Project summary

Our roles

Mobile App Development, AI Integration, Fintech

Industry

Fintech

Website

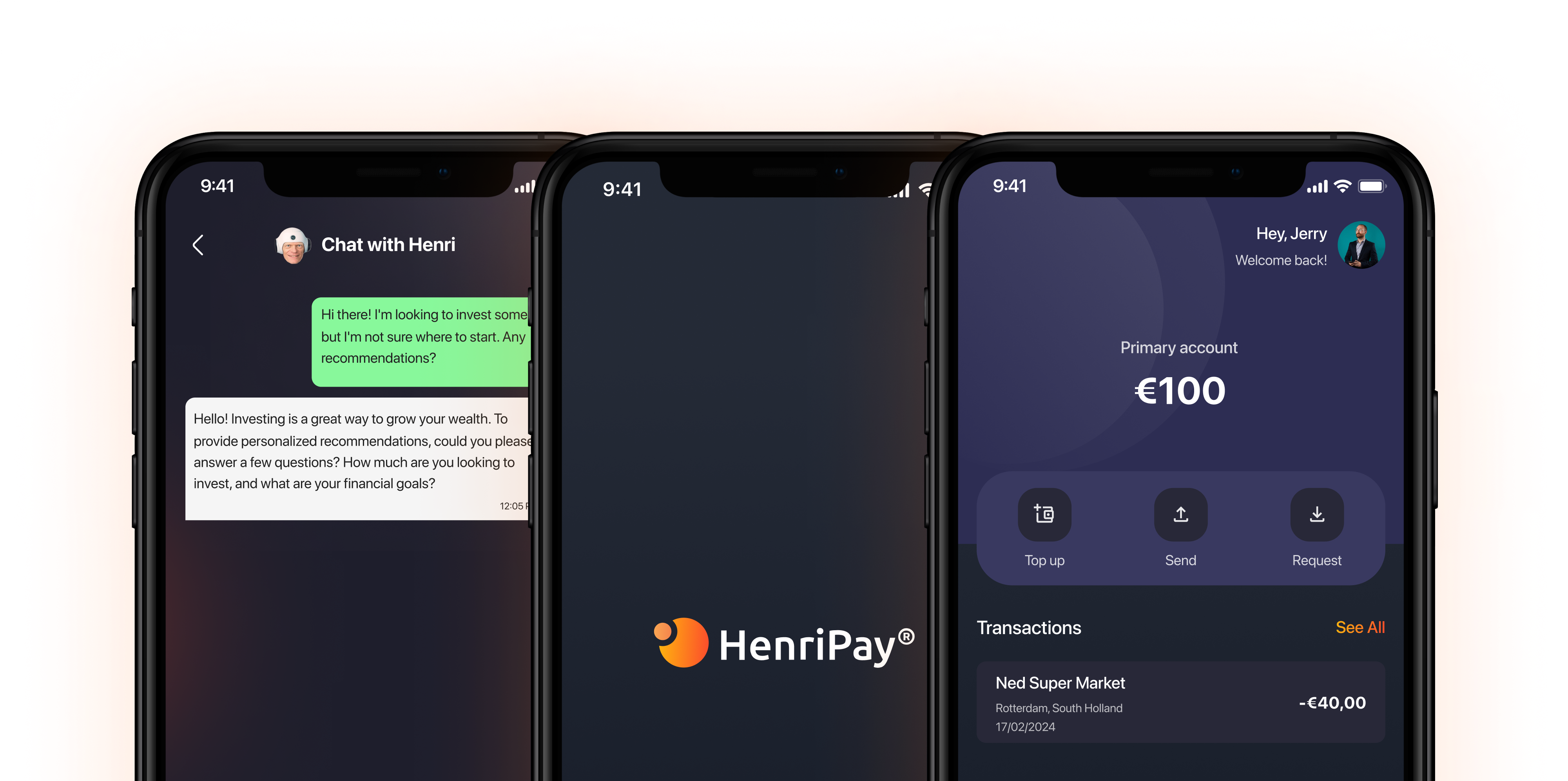

HenriPay is a fintech platform designed to transform personal finance by offering users personalized financial guidance, banking tools, and sustainability-focused features. Crebos played a crucial role as the primary development partner, responsible for building HenriPay’s scalable infrastructure and integrating advanced AI-driven personalization tools.

Challenge

HenriPay’s founders envisioned an app that would provide users with tailored financial advice, empower them to manage their finances, and promote sustainable financial behavior. The challenge was to create a platform that could support rapid user growth while offering real-time insights through AI-powered financial tools, banking services, and sustainability features like the carbon tracker.

Key challenges included:

- Developing a scalable architecture capable of supporting hundreds of thousands of users.

- Integrating advanced AI for personalized financial insights.

- Ensuring financial compliance with European regulations (GDPR, KYC, AML).

Technologies we used for this project

Our solution

Crebos delivered a robust and secure solution that met HenriPay’s ambitious goals. Key features include:

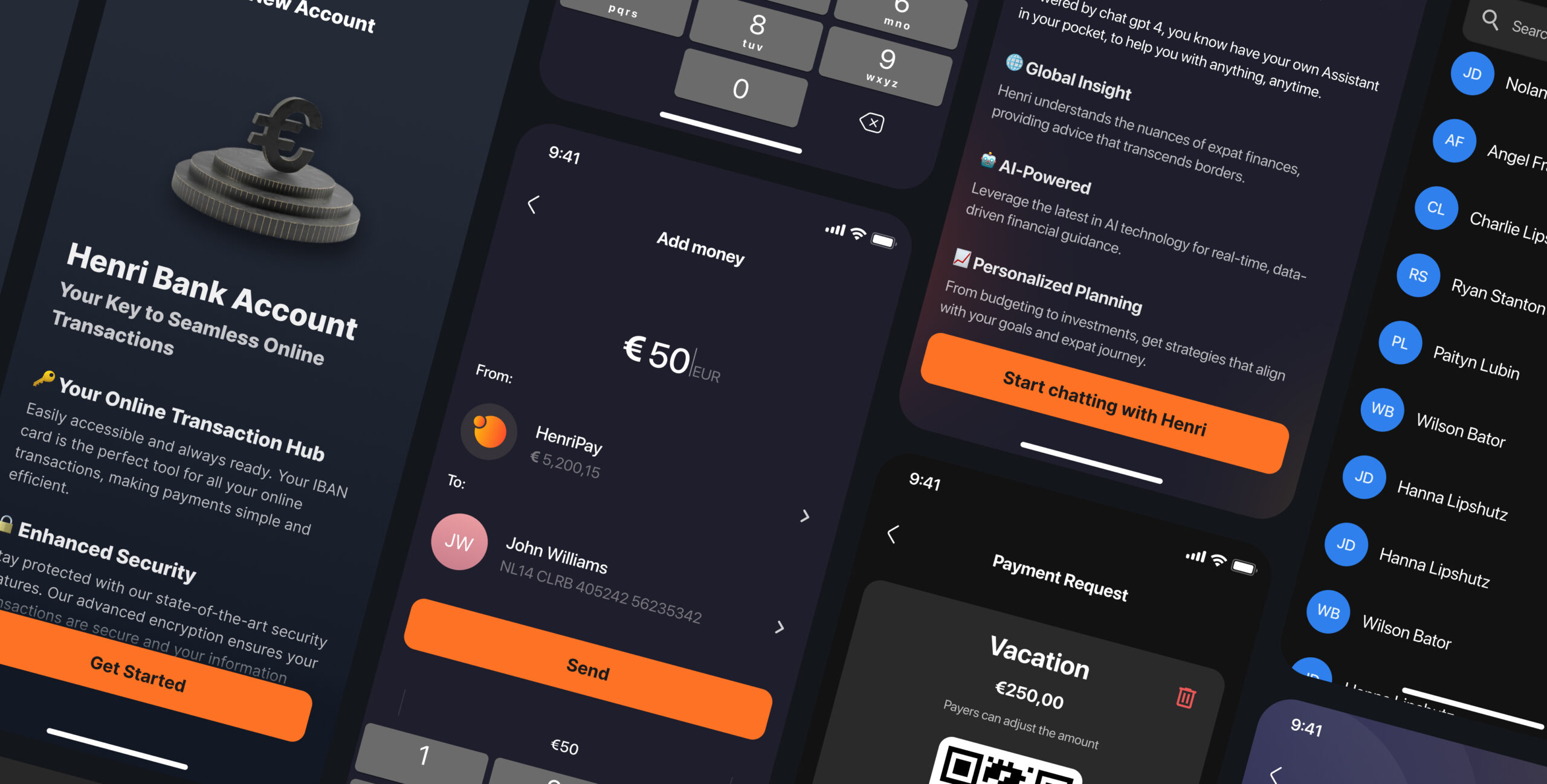

- AI-powered financial guidance: HenriPay’s virtual financial guide, powered by AI, offers tailored advice based on user behavior, helping users improve their financial health.

- Scalable architecture: Crebos developed a scalable infrastructure, ensuring the app could handle large-scale growth. This included secure payment gateways and infrastructure for IBAN accounts and KYC compliance.

- Comprehensive financial tools: The app includes IBAN accounts, virtual and physical debit cards, expense tracking, budgeting goals, and automated savings features.

- Sustainability integration: The carbon tracker helps users monitor their carbon footprint, aligning with HenriPay’s commitment to sustainability.

- User-centric design: Crebos focused on UX to create an intuitive interface, simplifying access to financial insights and tools.

Result

The HenriPay app has positioned itself as a leader in financial inclusion and sustainability:

- Financial inclusion: The app is designed to serve underserved users, such as young adults and expats, by offering easy-to-use financial tools and guidance.

- Sustainability: Through the carbon tracker and future green investment tools, HenriPay encourages environmentally conscious financial behavior.

- Scalability and growth: The app’s robust architecture has laid the foundation for future growth, with plans to expand into green investment opportunities and expat-centric services.

Stop forcing generic tools to fit a custom business.

Let’s build systems that match how your team works and help you scale faster.