We build, integrate, and automate financial systems that move money.

Trusted by banks, PSPs, acquirers, and global Fintech leaders. We build secure, high-velocity financial systems designed for scale. Zero-drama compliance. Enterprise-grade performance. Startup speed.

Facts & figures

Financial innovation used to be optional. Today, it’s survival.

Regulation is tightening. Customer expectations are rising. Digital challengers are taking market share at record speed. But most financial organizations are slowed down.

What we do

End-to-end product design

From concept to clickable prototypes. We align design with your brand, audience, and business goals.

Engineering Excellence

We build scalable, secure, and high-performing systems designed for financial-grade reliability.

Integrations & Automation

We connect platforms, automate workflows, and modernize legacy systems to move faster and smarter.

Proven Delivery

Fixed price. Faster launch. Zero surprises. We deliver months faster, with reliability trusted by Fintechs and financial institutions.

Our core Fintech capabilities

Innovation

MVPs, IoT/Bluetooth payments, super apps, UX/UI, rapid POC validation.

Migration

PSP/acquirer migrations, core system transitions, data lakehouse, iDEAL 2.0/Wero.

Integrations

Core/ledger, PSPs, KYC/KYB, AML stacks, PCI workflows, instant payouts (Visa Direct / Mastercard Send).

Modernization

Legacy system rebuilds, DevOps, SRE/DR, CI/CD, A2A/VRP, security & privacy, embedded finance.

Optimization

UX/UI, CRO, checkout optimization, revenue leakage detection, performance tuning.

AI & Automation

AI agents, RPA, operational back-office automation, AML/KYC automation, document extraction, risk decisioning.

Accelerating financial innovation

From idea → working product in 4–8 weeks.

We help banks, PSPs, and FinTechs design, test, and launch new financial products fast.

Why Fintechs and financial institutions choose Crebos

- Fixed price. Faster launch. Zero surprises.

- We deliver with startup speed and enterprise reliability.

- Deliver months faster.

- Proven reliability in regulated environments.

- We build what others delay.

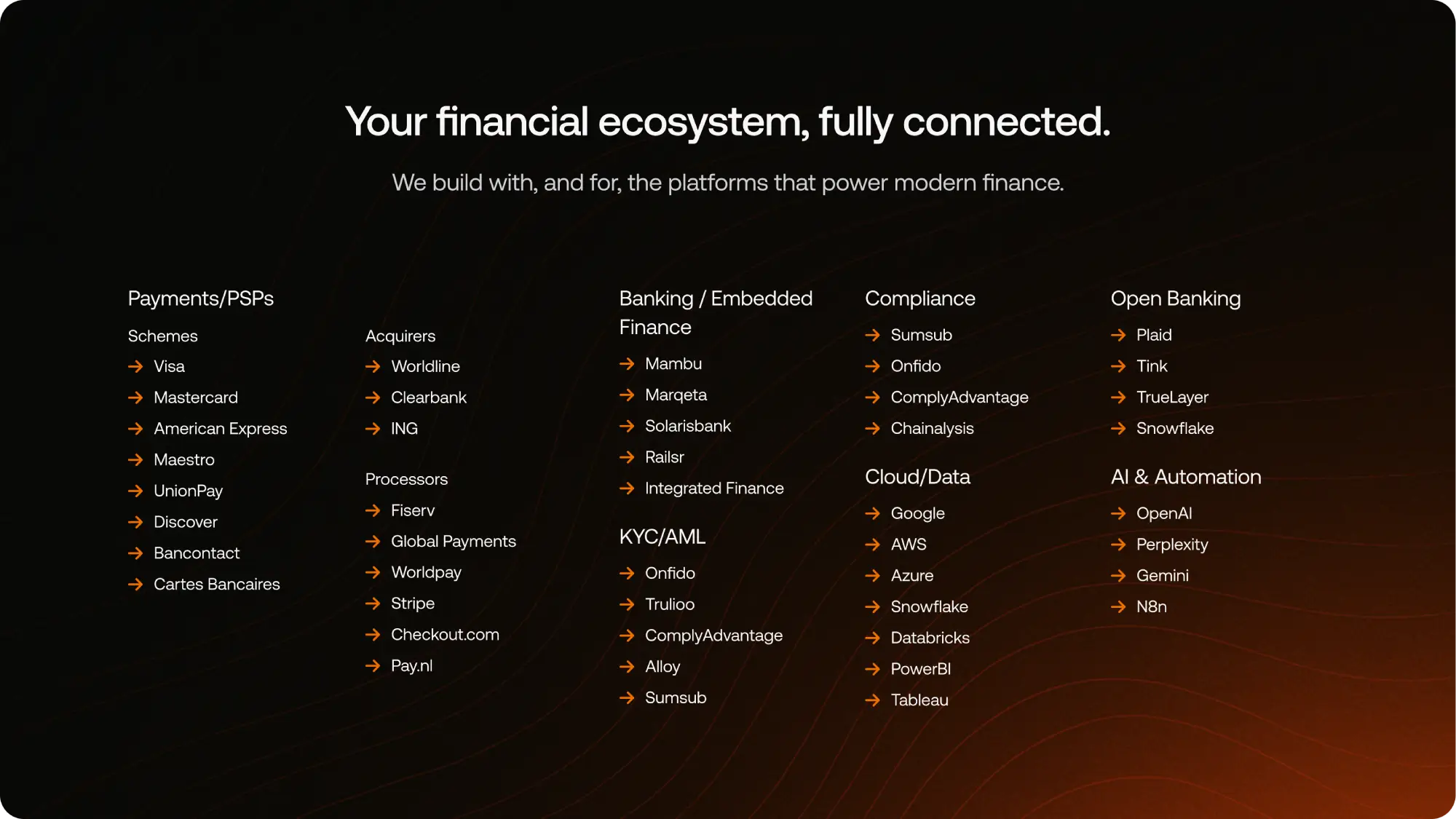

Integrations & Partners

Real results. Delivered at speed. At scale.

Statiegeld Nederland — RetourPin / National Deposit Refund System

- Built end-to-end in 3 weeks

- Real-time transactions, multi-system integrations

- Reporting & reconciliation

- 99.83% uptime nationwide

HenriPay — Neobank App

- Concept → live in 2.5 months (industry avg. 12–14 months)

- Multi-feature: literacy, banking, split payments

- Modular architecture for rapid expansion

- Secure onboarding & real-time balance engine

Fiserv — Payment Integration

- Fully integrated in 3 weeks (instead of 6–8 months)

- Scalable, high-volume processing

- 70% faster time-to-live

- Unified reporting dashboard

Let’s build the future of financial services. Together.

Whether you’re modernizing a banking stack, launching a new Fintech product, integrating critical systems, or automating operations Crebos delivers the speed, expertise, and reliability your roadmap demands.